Assuming the goal is more prosperity, lawmakers who work on tax issues should be guided by the “Holy Trinity” of good policy.

- Low marginal tax rates on productive activity such as work and entrepreneurship.

- No tax bias (i.e., extra layers of tax) that penalizes saving and investment.

- No complicating preferences and loopholes that encourage inefficient economic choices.

Today, with these three principles as our guide, we’re going to discuss a major problem in how dividends are taxed in the United States.

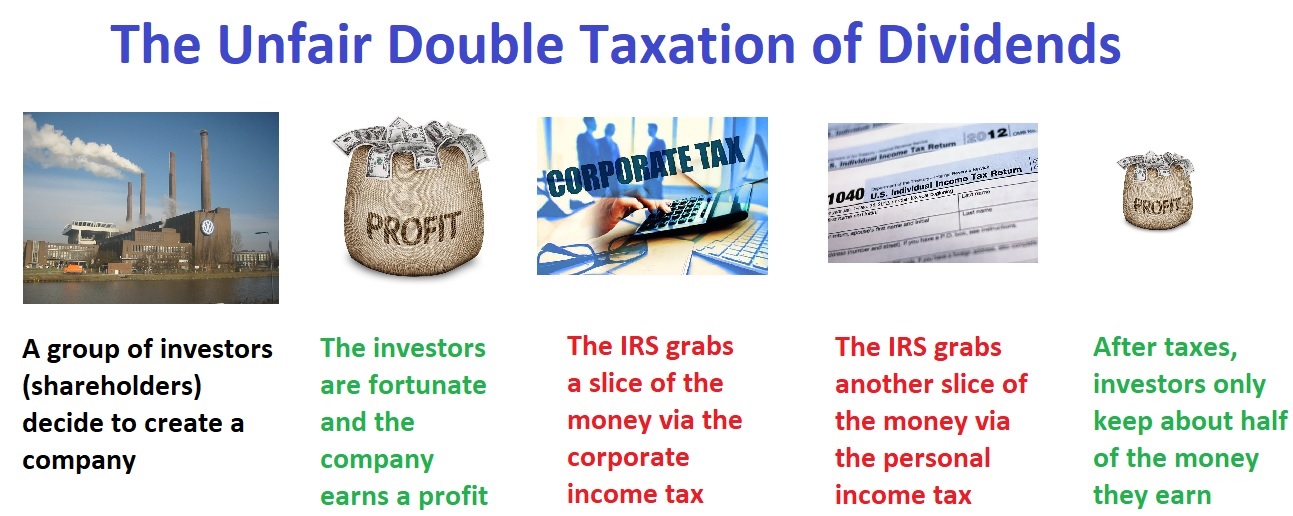

Simply stated, there’s an unfair and counterproductive double tax. All you really need to know is that if a corporation earns a profit, the corporate income tax takes a chunk of the money. But that money then gets taxed again as dividend income when distributed to shareholders (the people who own the company).

So why is this a bad thing?

From an economic perspective…

View original post 509 more words

PayPal

PayPal Boudica BPI

Boudica BPI Boudica BPI Sites

Boudica BPI Sites Boudica.us videos

Boudica.us videos Boudica.us webmail

Boudica.us webmail boudicabpi.boudica.us

boudicabpi.boudica.us boudicaus.wordpress.com

boudicaus.wordpress.com Queen Boudica blog

Queen Boudica blog tumblr

tumblr Adina Kutnicki

Adina Kutnicki Crockett Lives

Crockett Lives Cry and Howl award

Cry and Howl award cryandhowl

cryandhowl Debbie Schlussel.com

Debbie Schlussel.com Nebraska Energy Observer

Nebraska Energy Observer New Zeal

New Zeal Oathkeepers

Oathkeepers Puma By Design

Puma By Design Swiss Defence League

Swiss Defence League The Mad jewess

The Mad jewess the religion of peace

the religion of peace theodores world

theodores world warsclerotic

warsclerotic Queen Boudica

Queen Boudica Boudica

Boudica Ann Coulter

Ann Coulter Michelle Malkin

Michelle Malkin If you don't like my opinions

If you don't like my opinions feedjit

feedjit The myths of Muhammad

The myths of Muhammad